More than 2 crore vehicles are registered in India annually.

That’s a significant amount of road tax revenue.

And if you have a car, scooter, or truck, you’re already a part of that system. But here’s the twist: most car owners still don’t know how, when, or where to remit their road tax, not to mention the fact that you’re able to do it online in less than 10 minutes.

No more RTO queues, no complicated forms, and certainly not any dealing with middlemen.

Whether you need to pay road tax online, check your Parivahan road tax dues, or want to know about the offline process of road tax payment, this blog explains everything step by step. Hang tight, as payment of your car tax is a whole lot easier now.

Let’s hit the highway.

What is Road Tax, and Who Needs to Pay It?

The road tax is a compulsory charge levied by the state governments according to the Motor Vehicles Act. It goes towards keeping the roads, highways, and transportation infrastructure in the country. Every private or commercial vehicle, whether a two-wheeler, a car, a bus, a truck, or a transport van, has to pay this tax.

The tax rate differs according to:

- Vehicle type (private/commercial)

- Fuel type (petrol/diesel/electric)

- Engine capacity

- Vehicle age

- State of registration

Every state has its different state vehicle tax payment system, and that is why you need to know how to make a payment in your area.

How to Pay Road Tax Online

Let us begin with the most accessible option: payment of road tax through the internet using the Parivahan or Vahan portals.

Step 1: Visit the Parivahan Portal:

Go to https://parivahan.gov.in and select Online Services > Vehicle Related Services.

Step 2: Select Your State:

As tax for vehicles is state-based, you will be directed to your respective RTO portal through the Vahan system.

Step 3: Enter Vehicle Details:

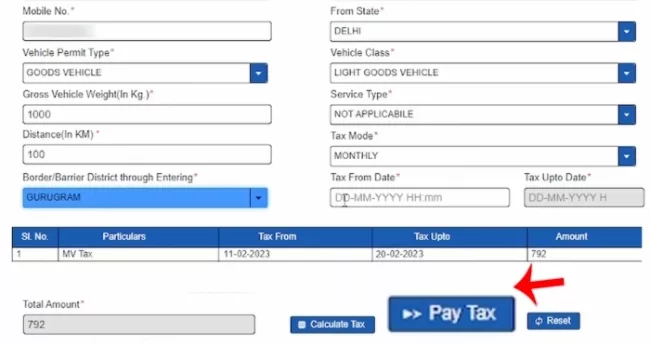

Choose “Pay Tax” or “Tax Payment” from the menu on the Vahan portal.

- Enter your vehicle registration number.

- The system will retrieve information including ownership, fitness, and insurance status.

Step 4: View Tax Dues:

The portal will automatically calculate your tax from your vehicle’s make, model, and state of registration. That way, you’re guaranteed to get the right amount without any guesswork.

Step 5: Make the Payment

- Select your payment option: UPI, debit/credit card, or net banking.

- A nominal convenience charge, typically 1%, may be charged.

Step 6: Download the Receipt:

After a successful transaction, save and download the receipt. It is your proof of payment and will be necessary at the time of an inspection or renewal.

And you are done! You’ve finished paying for your Vahan tax in a matter of minutes.

Why Use Parivahan or Vahan for Road Tax?

- Secure and accepted by the government

- The amount is automatically calculated

- Generation of receipts instantly

- No middlemen, no additional fees

- Operates in most Indian states

Additionally, this procedure promotes green vehicle policies, for example, in some states, EVs frequently qualify for tax rebates of up to 50%. If you qualify, the system will automatically apply the discount.

How to Pay Road Tax Offline

Still want to go the traditional way? Here’s how offline road tax payment is done.

Step 1: Visit the Local RTO:

Proceed to the RTO where your car is registered (or to where you are moving, in the event of re-registration).

Step 2: Collect Form 20 or 25:

Depending on your circumstances (new registration, re-registration, etc.), get the specified tax form from the counter.

Step 3: Submit Documents:

Attach the following:

- Vehicle invoice or RC

- Valid insurance

- Pollution Under Control (PUC) certificate

- Proof of address

- ID proof

Step 4: Pay the Tax in Cash or DD:

Pay the calculated tax at the counter through cash or a demand draft. Some RTOs also accept card payments.

Step 5: Collect the Payment Slip:

You’ll be issued a stamped receipt — keep this safe with your RC. This proves you’ve completed the state vehicle tax payment process.

When Do You Need to Pay Road Tax?

Do you find it confusing when you need to pay road tax? Worry not, just go through the points below and see if you are eligible:

- Purchase of a new car: Typically, during the period of registration

- Vehicle transfer between states: Must pay road tax in the new state within 12 months of relocation

- Annual renewal: For some types of vehicles or states that don’t permit lifetime tax

How to Check Your Road Tax Payment Status

After you’ve paid, whether you’re paying online or offline, it is a prudent practice to verify the status. Check your road tax payment status by following the steps below:

- Visit https://vahan.parivahan.gov.in

- Click on “Know Your Vehicle Details”.

- Enter your car registration number.

- You will find a record of every important transaction — tax payment, RC validity, fitness status, and more.

Conclusion

Since the transportation system is becoming increasingly digital, paying your road taxes online is a wise and effective way to maintain compliance with Indian traffic regulations. Platforms such as Parivahan and Vahan have made the process quick and dependable, whether you’re buying a new car, renewing your policy every year or moving states.

However, there is still an option for paying road taxes offline if you feel more at ease with paperwork and human interaction. In any case, the important thing is that your taxes are paid and your car remains legal.

As a result, there will be no confusion or chaos the next time you need to pay road tax, check your Vahan status, or verify your details.

FAQs

Q. Can I make an online road tax payment for any state in India?

The majority of Indian states are currently included in the Parivahan and Vahan portals. Some may still reroute to websites unique to each state.

Q. What occurs if I don’t pay my road tax?

A fine of up to 10% of the outstanding balance could be imposed on you. Persistent nonpayment may also result in fines or limitations when reregistering a vehicle.

Q. If I move states, will I be eligible for a road tax refund?

Yes, but only after you’ve filed the required paperwork for a refund in the prior state and re-registered your car in the new state.

Q. Is it required to have the road tax receipt on hand?

Definitely, particularly for commercial checks or interstate travel. You could get a soft copy if you paid online.