Every vehicle owner in India must pay road tax, a compulsory tax collected by the state government for using public roads. This tax becomes essential to help the government upkeep road networks, highways, and other transport infrastructure.

As different states have different rules, road tax rates and payment procedures vary significantly throughout India. For vehicle owners in Punjab, understanding how road tax is computed, the existing rates, and the payment methods available for easy payment becomes relevant.

Table of Contents

What is Road Tax and Why is it Important?

In India, road tax is enforced by both the state and the central governments, but it is a state-level tax. For instance, if you purchase or possess a vehicle in Punjab, you must pay road tax to the Transport Department of Punjab per the state’s regulations.

Importance of Road Tax

Paying road tax is not just a legal formality but also benefits individuals and states.

- Funding Road Infrastructure and Maintenance: Road tax contributes to the state’s revenue, which is utilised for road construction, repair, and maintenance of roads, bridges, flyovers, and other transportation infrastructure.

- Supporting Road Safety and Public Services: The funds from road tax are not limited to road construction—they also contribute to road safety measures. The states use these collections for road construction, maintenance, safety, and emergency services.

- Ensuring Legal Compliance: Paying road tax is mandatory for vehicle owners. If owners do not pay, they may face penalties, fines, or the possibility of their vehicle registration being cancelled or their vehicle being seized.

Road Tax Rules in Punjab

The road tax is levied under the Punjab Motor Vehicle Taxation Act, 1924.

Applicability of Road Tax in Punjab

The rates of the road tax differ according to the following categories of vehicle:

- Four-Wheelers (Private Use): Private cars are taxed based on seating capacity (e.g. up to 4, 5, or 6 seats) and vehicle age. Those under 3 years pay higher tax; older vehicles pay less.

- Commercial Vehicles: This includes taxis, buses, and goods transport vehicles like trucks and delivery vans. Stage carriages or vehicles with tourist permits have their specific rates or even per-seat/per-km charges.

- Other State Vehicles Operating in Punjab: Vehicles registered outside Punjab but plying in Punjab may also have to pay road tax under specific rules, often pro rata.

Factors Affecting Road Tax Rates

The amount of road tax a vehicle owner pays in Punjab varies as per several factors. Listed below are some of those key factors:

- Vehicle Type: The type of vehicle (two-wheeler, four-wheeler, commercial vehicle, or luxury car) has a direct impact. Private cars and motorcycles are usually taxed at a one-time rate, while commercial vehicles often pay quarterly, monthly, or even daily tax.

- Vehicle Age: Newer vehicles generally attract higher road tax. As the vehicle ages, the applicable tax rate decreases due to depreciation. However, some cars might be subject to the “green tax,” discussed below.

- Vehicle Cost: Luxury vehicles and high-end cars attract higher tax rates. For instance, cars priced above ₹15 lakh or ₹25 lakh may face a percentage-based tax rather than a fixed amount.

- Fuel Type: Traditionally, diesel vehicles attract higher road tax due to their higher emissions. On the other hand, electric vehicles (EVs) are given tax rebates or exemptions to encourage eco-friendly transportation.

Lifetime Tax, Green Tax, and Exemptions

- Lifetime Tax: Lifetime tax is a road tax paid once while registering a private vehicle. If your car is registered in Punjab and the lifetime road tax has been paid, you do not have to pay again.

- Green Tax: Green tax is imposed on old vehicles, particularly those over 15 years old. Punjab charges a green tax on older diesel and petrol vehicles but excludes environmentally friendly vehicles driven by LPG, CNG, battery, or solar power.

- Exemptions: Punjab grants exemptions to electric vehicles (EVs) under Punjab’s EV Policy 2022 to promote the adoption of green mobility. Government vehicles belonging to central or state government departments and special category vehicles for differently-abled individuals are also eligible for full or partial exemption.

How to Calculate Road Tax in Punjab?

The amount of road tax payable in Punjab is not fixed but is based on specific parameters.

Parameters Used for Road Tax Calculation

The table below discusses the standard parameters used for road tax calculation:

| Factors | Description |

| Category of Vehicle | Whether it’s a car, bike, scooter, bus, truck, or any other type of vehicle. |

| Engine Power | The cubic capacity (CC) or engine size in litres that influences tax slabs. |

| Weight of Vehicle | Based on gross weight (GVW) or kerb weight, which is especially important for heavy vehicles. |

| Vehicle’s Age | The number of years since the car was manufactured or registered. |

| Fuel Used | Petrol, diesel, CNG, hybrid, or electric—fuel type often impacts tax rates. |

| Place of Registration | The state or district where the vehicle is registered, as road tax varies regionally. |

| Vehicle Price/Value | Sometimes, tax is calculated as a percentage of the invoice value or market price. |

Sample Road Tax Calculation for Different Vehicles

For new cars (private use), road tax is charged as a percentage of the ex-showroom price, usually 2% of the car’s value. Here’s a table with a practical example showing how road tax varies for different types of cars:

| Vehicle Type | Price | Tax Rate | Road Tax Payable |

| Hatchback (Petrol) | ₹6,00,000 | 2% | ₹12,000 |

| SUV (Diesel) | ₹15,00,000 | 2% | ₹30,000 |

| Electric Car | ₹12,00,000 | 0% (Exempted) | ₹0 |

Note: These are sample figures. Actual road tax in Punjab varies based on the latest RTO updates, vehicle location, and specific vehicle configurations.

How to Pay Road Tax in Punjab?

Various road tax payment processes are listed below:

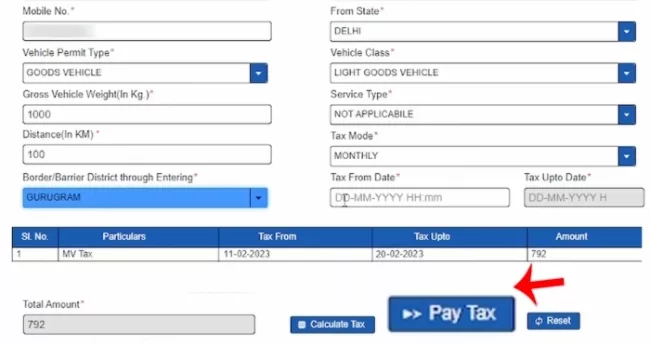

Online Payment Process

Payment of your road tax in Punjab is much simpler with the state’s online payment system. This saves time and makes the process quicker and more transparent, too. Go through the following steps to make an online payment of road tax:

- Step 1: Visit the official Parivahan website.

- Step 2: Select the “Vahan Service.”

- Step 3: Enter your vehicle registration number, state, and RTO.

- Step 4: Click on “Online Services” and select “Pay Vehicle Tax.”

- Step 5: Enter the last five digits of the Chassis No. and click on “Validate Regn_no/Chasi_no.”

- Step 6: Generate the OTP. You will receive an OTP on your registered mobile number. Enter the OTP and submit.

- Step 7: Update Insurance details and then review the fee panel. Click on proceed.

- Step 8: Pay the tax amount and download the payment receipt generated.

- Step 9: The application would be moved to RTO for further processing.

Offline Payment Process

If you prefer to pay road tax offline, you can do so at the nearest Regional Transport Office (RTO) or an authorised tax collection centre. The process usually involves:

- Step 1: Go to Punjab’s closest RTO or authorised tax collection centre.

- Step 2: Take the required documents, including the vehicle registration certificate (RC), identity proof, and address proof.

- Step 3: Collect and complete the road tax payment form provided at the office.

- Step 4: Submit the form accompanied by the necessary documents.

- Step 5: Make the road tax payment in cash, cheque, or demand draft (as accepted by the RTO).

- Step 6: Collect the payment receipt from the RTO. Save this receipt carefully, as it is considered formal proof of payment.

Documents Required for Road Tax Payment

When paying road tax, either online or offline, you’ll need to submit the following documents:

- Vehicle invoice copy

- Vehicle Registration Certificate (RC)

- No Objection Certificate (NOC) (for out-of-state vehicles)

- Valid vehicle insurance copy

- Form KMVT14 (applicable for out-of-state vehicles)

- Proof of address, such as Aadhaar Card, Passport, Voter ID, Ration Card, Rental Agreement, or Utility Bill

Penalties for Late Payment of Road Tax in Punjab

As per the Motor Vehicle Act, paying road tax on time is mandatory. Delays or non-payments can attract heavy fines, which vary depending on the delay period and the number of offences. A short grace period (usually 15 days) may be given to clear dues.

| Delay Situation/Period | Penalty/Fine |

| Delay in payment (general) | 50% – 100% of arrears in road tax |

| First-time offence (neglect in payment) | Fine equals 2 quarters of road tax |

| Repeat offences | Fine equal to or more than annual tax (up to 2x yearly tax) |

| Minimum fine | ₹300 (cannot be less than this amount) |

| Previous conviction under Section 16 of the MV Taxation Act | ₹500 – up to double the tax payable on the vehicle |

Note: The numbers above are merely estimates. The taxing authority has the last say over actual penalties, which can change depending on particular situations.

Refunds and Road Tax Transfer Rules in Punjab

Tax refunds are possible for many vehicle owners in Punjab. Here are details on how and under what circumstances you can claim a refund.

Conditions for Road Tax Refund

- Selling the Vehicle: If, during the tax period, you have decided to sell your vehicle, you can claim a refund.

- Inter-state Transfer: Since you must pay the road tax to the new state you’ve moved to, you can claim a refund from the previous state.

- Vehicle Disposal: If you dispose of your vehicle before the registration certificate’s (RC) validity of 15 years, you can claim a refund.

Procedure for Applying for a Road Tax Refund/Transfer

The following procedures must be followed to apply for a refund:

- Visit RTO: Go to the RTO where your vehicle was registered.

- Apply: Fill out the refund request form.

- Submit Documents: RC, original tax receipt, proof of scrapping/relocation, and NOC (if moving states).

- Verification: RTO reviews and approves the refund based on vehicle age and tax period.

Comparison: Road Tax in Punjab vs Other States

The table provides a comparison of taxes of different states, based on a private car from₹10 lakh and the corresponding electric vehicle (EV) tax status:

| State | Road Tax for Car (₹10L) | Electric Vehicle Tax |

| Punjab | ₹95,000 – ₹1,30,000 (9.5% – 13%) | Exempted (100%) |

| Delhi | ₹1,00,000 – ₹1,50,000 (10–15%) | Exempted (100%) |

| Maharashtra | ₹1,10,000–₹1,30,000 (11–13%) | Exempted (100%) |

| Kerala | ₹130,000–₹160,000 (13–16%) | 5% up to ₹15 lakh |

Note: Road tax rates are estimates that could change depending on the characteristics of each vehicle and RTO evaluations.For accurate computations, always refer to the RTO for the relevant state.

Punjab road tax is essential for funding road infrastructure and smoother transport throughout the state. The tax rates differ based on vehicle category, engine capacity, age, fuel, and price. Provisions for lifetime tax, green tax, and recent amendments in tax for electric vehicles ensure that the system balances revenue requirements with environmental considerations.

Vehicle owners can simply compute and pay their fees online via the Punjab Transport Department portal, which makes compliance convenient. Being informed of the new rules avoids the imposition of penalties and ensures smooth driving on the roads in Punjab.

FAQs about Road Tax in Punjab

Q. Is the lifetime road tax applicable in Punjab?

Private vehicles in Punjab are generally charged a one-time lifetime road tax at registration, meaning no annual road tax is required unless the vehicle is transferred or re-registered in another state.

Q. What are the penalties for the non-payment of road Tax in Punjab?

Heavy penalties are incurred if the road tax in Punjab is not paid. The vehicle owner will be charged ₹1,000 to ₹5,000, based on how late the payment is made. Without paying the road tax on time, a penalty of 50% to 100% of the pending payment amount may also be charged.

Q. What is the difference between road tax and toll tax?

Road tax is an annual tax paid to the state government upon registration of a new vehicle. It supports road construction and maintenance in Punjab. Toll tax is a usage charge levied by the National Highways Authority of India (NHAI) or state governments when vehicles use highways, expressways, or bridges.

Q. My vehicle was registered in another state, and I have moved to Punjab. Can I drive this vehicle in Punjab?

Vehicles that have been registered in another state but have been operating for more than 12 months in Punjab need a permit. The car owner also needs to pay road tax to Punjab. The payable amount is calculated on a pro rata basis, considering the remaining period of the road tax in the home tax.

Q. How do I apply for a road tax exemption?

If your vehicle is eligible for an exemption, claim it at the closest RTO along with your RC and provide evidence of eligibility (such as disability, diplomatic, or government records). On acceptance, your vehicle will be exempted, and no road tax will be levied.